california property tax payment plan

File a written request with the Tax Collectors office prior to the due date of the bill. Room 101 E Visalia CA 93291.

This plan provides a means of paying secured.

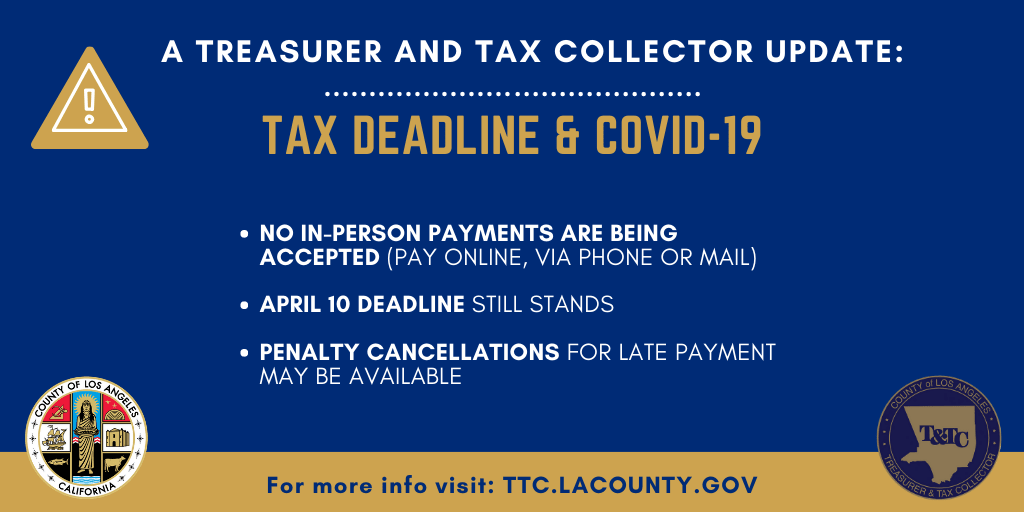

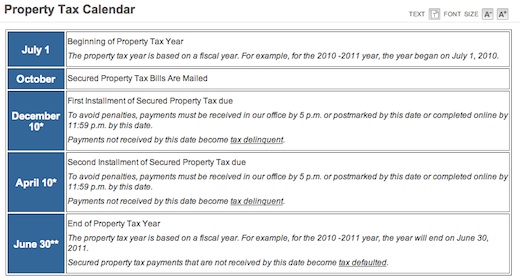

. Between November 1 and January 31 the first half of the current year taxes must be paid. The Office of the Tax Collector is responsible for collecting taxes on all secured and unsecured property in Orange County. Any of the following conditions will default cancel an active four-year payment plan.

Two types of Payment Plans either monthly or annual - are now available to taxpayers with real property that has unpaid prior year property taxes going back up to five 5 years. The BOE acts in an oversight capacity to ensure compliance by county assessors with property tax laws regulations and assessment issues. Make monthly payments until my tax bill is paid in full.

To enroll a bill on the Four Year Payment Plan you must. This office is also responsible for the sale of property subject to. Succeeding installments not received by August 31 for unsecured taxes each year.

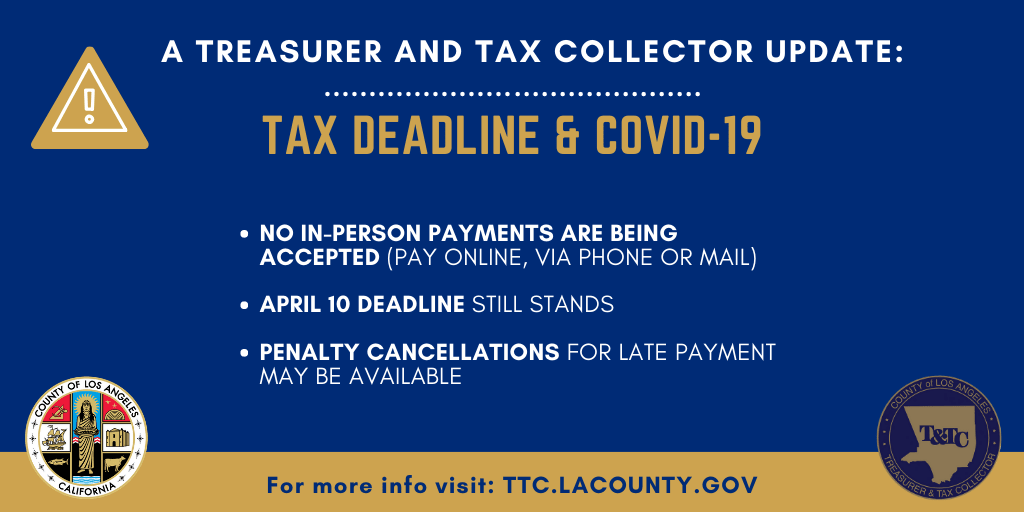

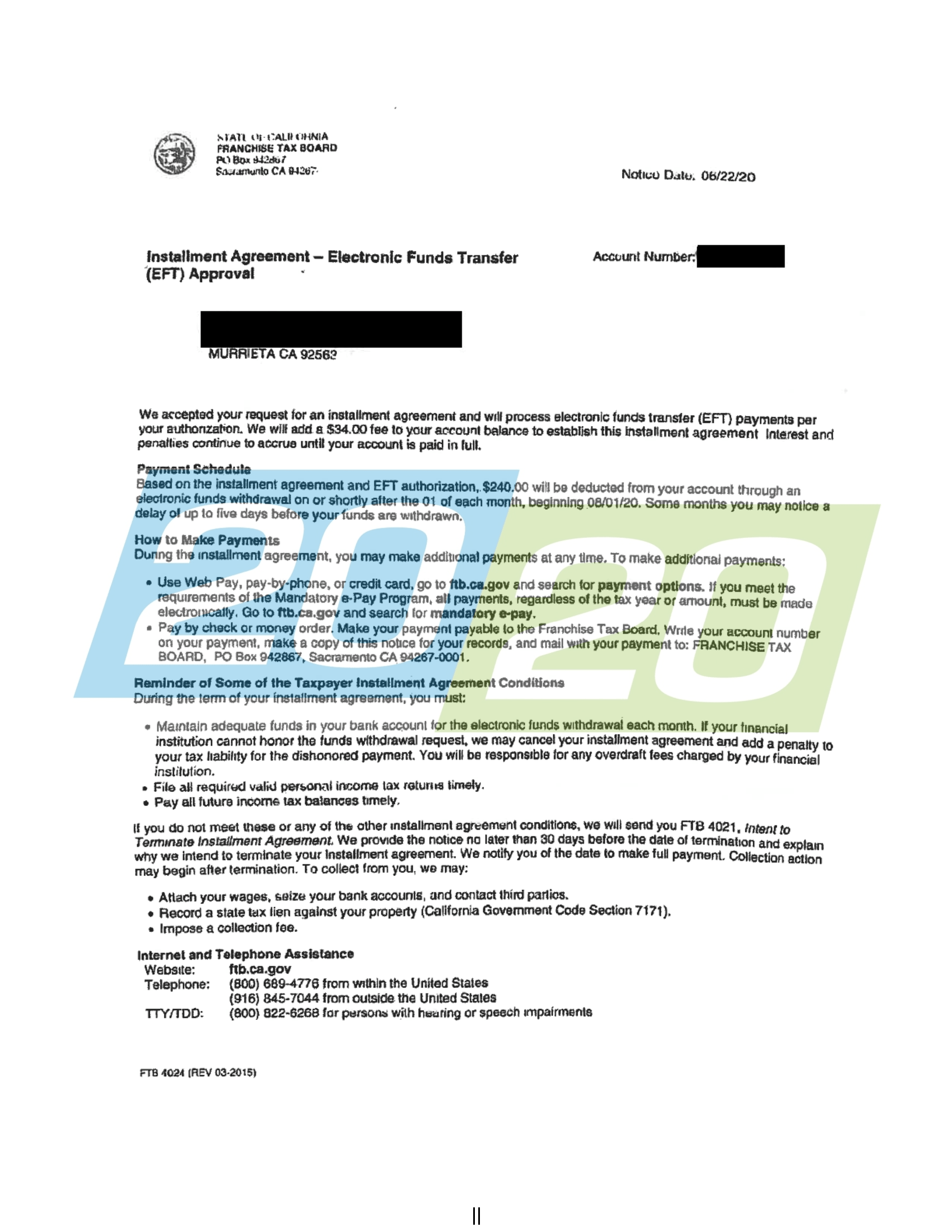

If you have any questions regarding this Payment Plan please call the Tax Collectors Office Secured Property Tax Unit between 900 am. Online Phone 800 689-4776 Mail Installment Agreement Request Business If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment. No fee for an electronic.

You can pay online by credit card or by electronic check from your checking or savings account. The Online Property Tax Service is provided to allow easy access for the public to Pay Print and View El Dorado County Property Tax Bills. Please be aware of the following regarding EFT.

Keep enough money in. Complete the application and pay the 4800. Between February 1 and June 30 the full year current taxes must be paid.

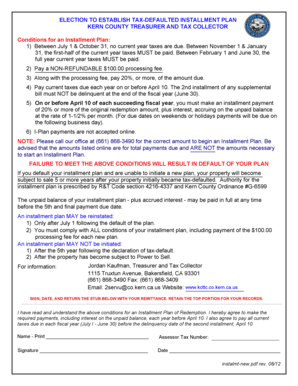

For prior year secured property tax delinquencies a property owner may initiate an installment plan of redemption to redeem the property. To perform the oversight. 559-636-5280 221 South Mooney Blvd.

Pursuant to California Revenue and Taxation Code Section 48375 taxes due for escaped assessments for a prior fiscal year s may be paid without penalty over a four-year period. Pay a 34 setup fee that will be added to my balance due. Business and personal property taxpayers in Santa Clara County now have access to SCC DTAC a new mobile app launched by the County of Santa Clara Department of Tax and Collections to.

Monday through Friday excluding. A convenience fee of 25 will be charged for a credit card transaction. Pay by automatic withdrawal from my bank account.

Aci Payments Inc Pay California Property Taxes Online

Property Taxes Department Of Tax And Collections County Of Santa Clara

Kern County Property Tax Fill Online Printable Fillable Blank Pdffiller

Pay Your Property Taxes Treasurer And Tax Collector

California Property Tax Calculator Smartasset

Property Assessed Clean Energy Programs Department Of Energy

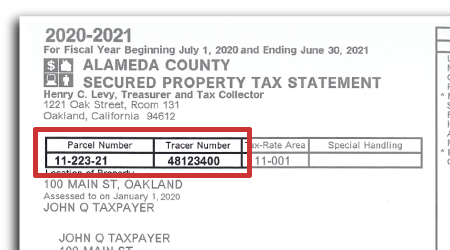

Annual Secured Property Tax Bill Placer County Ca

Pay Your Property Taxes Treasurer And Tax Collector

Attn California Refinancers Property Taxes Due At Closing The Basis Point

California Property Tax Postponement Program Alta California Regional Center

California Property Tax Calendar Escrow Of The West

Property Tax Payments At Law Office Of David Lee Rice

State Accepts Payment Plan In Murrieta Ca 20 20 Tax Resolution

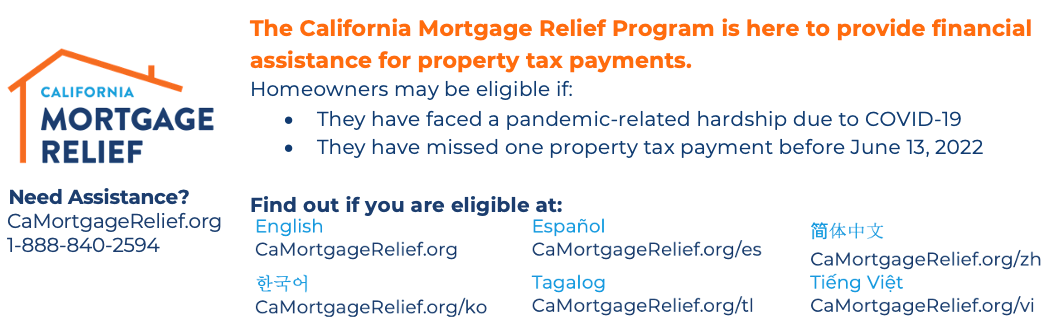

Solano County Assistance Programs

What California Homeowners Should Know About Supplemental Tax Bills Quicken Loans

Pay Property Taxes Or Obtain Tax Bill Information Yolo County

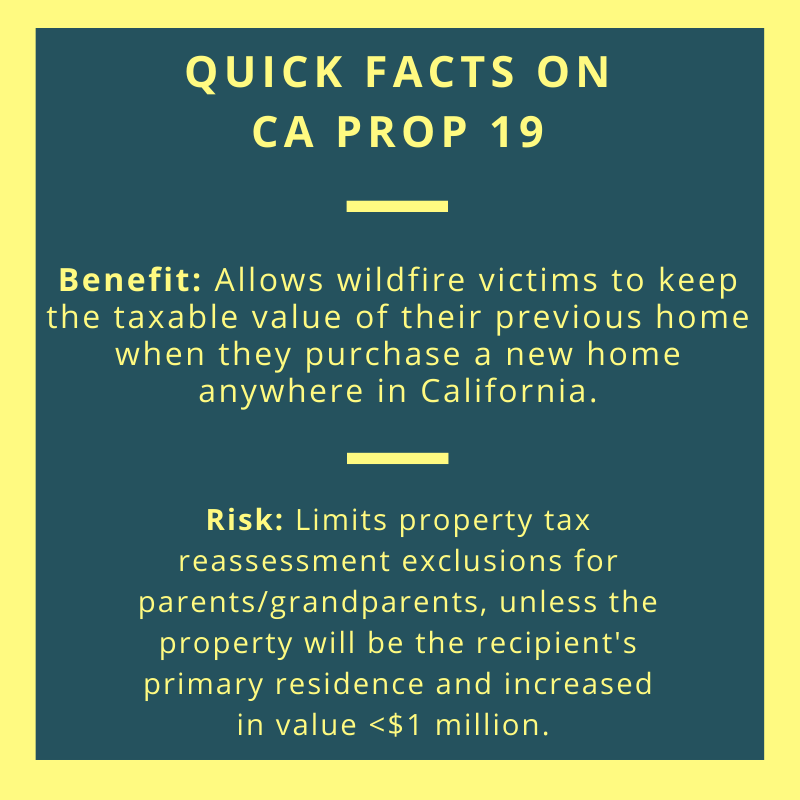

How Prop 19 Could Affect Your Estate Plan Law Offices Of Daniel A Hunt